Make Mars Great Again

Maritime Ventures Newsletter 3.5

This month in the Maritime Ventures Newsletter

Welcome to the October edition of the Maritime Ventures Newsletter, your source of the latest news and insights from the world of maritime tech deals, software, sustainability and innovation. If you have any feedback, questions, or suggestions, please feel free to contact me by replying to this email or follow me on LinkedIn.

Anyways, grab yourself a good cup of coffee, tea or a beer and enjoy a snapshot of the pulsating life of maritime software, sustainability, and innovation. Happy reading!

Monthly Commentary

A month of big things happening, most notably the chopsticks that captured a 3600 tonnes rocket as tall as a 27 story building, as well as the final month leading up to what will be a defining election for the coming years - both for shipping (trade wars / protectionism, decarbonisation) as well as the wider geo-politics.

On the note of faking it till you make it.. How do you really model the behavior (and fuel consumption) of a ship? Well, the entry level modelling is to take the shop test data from when the ship was built, and use that as a baseline to measure against. I hope most of the vessel performance software companies out there have progressed past this level, as it’s now clear most (or all?) engines built in Japan the last 25 years will have inaccurate shop test data. How to measure what is good performance if your baseline is wrong? The advanced players will have an answer for this, luckily - it’s just a matter of finding them.

The space of cybersecurity has been boosted in recent times, this month with two acquisitions by DNV and Marlink, of Cyberowl and Port-IT respectively. Two different approaches to the cyber threat - who has the most right to play?

Cybersecurity as a part of the wider offering around (but not part of, of course) the classification offering, or

Cybersecurity as a standard part of the ship-to-shore communications offering.

Alternatively, is it two different layers of the stack?

Speaking of layers, if you’re interested in a great article on Generative AI and the layers of that stack (and where the excitement of Sequoia is at the moment), have a look at the Tidbits (also for a curious outcome of Apple’s AI efforts).

In any case, I hope the acquisition of CyberOwl (and hence exit for a few) leads to more capital being re-deployed into fresh maritime tech startups.

Maritime Technology Ventures featured in media

On Deals

Early Stage (Seed + A)

OpenTug raises $3.1M to grow marine operator network - Seed round led by Entrada Ventures with participation from SpringTime Ventures and Stout Street Capital, at a valuation of US $10.1m according to Pitchbook (assuming it’s post-money, so a US $7m pre-money valuation). Claims access to 40% of (US) barge capacity on their platform, servicing over 3m tonnes of cargo in 2023.

€8.5m in new funding for ocean data firm north.io - More offshore than maritime (for now), with Hamburg-based VAERING investing in the ocean data business, alongside existing investors Possehl Group.

GTT Strategic Ventures invests in Bluefins - A French hydrofoil company, inspired by tail fins of whales, raises €3m from BNP Paribas, Breizh Up and Bluefins’ existing share holders including Ifremer, alongside GTT Strategic Ventures. Technology aims to reduce fuel consumption by around 20% and enhances stability of vessels by reducing pitching.

Growth Stage (B+)

Container tracking software firm Gnosis Freight gets new investment - Undisclosed sums, gets investment from PE-firm Vista Equity Partners and their Endeavor Fund, which provides growth capital to software and data companies with at least $10m in ARR.

Altris Welcomes Clarios and Maersk Growth as New Investors in Series B1 Funding Round - Raised a SEK 150m (US$ 14.4m) round to finalise a pilot plant that enables commercial production of sodium-ion cathode material for battery cells. First tranche of a Series B round, with Maersk being the notable one, alongside existing investors EIT InnoEnergy and Molindo. Targeting three key industry verticals: grid storage, low voltage vehicle applications and marine applications, Maersk was excited by their “superior energy density with a lower emissions profile and safety credentials”.

Nuclear power for shipping pioneer CORE POWER swells funding to $500m - Adding more funding from “household names in the shipping industry” and sharing about progress in Japan, announcing a deal with Mitsubishi Research Institute - trading houses putting in more money?

M&A

DNV buys CyberOwl - An exciting transaction for maritime startups, lighting up a pathway to exit! Undisclosed terms. Will operate standalone from the classification business.

Marlink buys maritime cyber firm Port-IT - Another cyber-security deal, on top of the above deal as well as the second deal for Marlink recently, adding on to the managed IT products portfolio. Port-IT’s base of 7000 vessels and security operations centres (SOC) in Netherlands and Bangkok will be merged with the Marlink and Diverto organisations, leading to 130 staff and four SOCs. Undisclosed sums.

Orbyt Global buys Otesat-Maritel - Greek telecom company OTE Group sells their 94% stake in Otesat-Maritel, their maritime comms division, to Orbyt Global - a provider of maritime satcom services to over 6000 vessels, rapid growth from their founding in 2021. Rapid acquisition spree, offering Inmarsat, Iridium, VSAT and Starlink services alongside a range of digital vessel navigation and operations systems.

Wellbeing provider OneCare Group announces partnership with WellAtSea - The seafarer wellness program company, which was acquired by training-provider Seably two years ago, seems to have found a new home. While not being communicated as an acquisition, it sure looks like one.

Nortel-investorer går maritimt [Nortel-investors goes maritime] - Telecom founders and investor group acquires 52% of Ccom, a Norwegian fleet and safety management software system, currently with 1000 vessels on their platform. Chips in NOK 10m into the company. The telecom team, who built, IPO’d and sold a B2B telecom Co in Norway (for ~US$50m), enters the company’s management team and board.

MOL to merge tech subsidiaries - Not the classical merge of two parties, but MOL doing an internal merger of maritime technology and engineering subsidiaries, with “services ranging from maritime and new shipbuilding consulting maritime human resources training, crew support, operational support and maintenance.”

Energy Solutions buys Oceanic Systems - A marine electrical systems supplier acquires a marine monitoring and control systems manufacturer. Undisclosed sums.

On Emissions Transparency

Shell and Aramco-backed Daphne Technology spins off its sulphur and carbon abatement technologies arm - The methane slip abatement and emissions measurement tools remains in Daphne Technology, while the sulphur (scrubber) and CO2 management (capture) solutions are now “Daphne Solutions”. Both companies will have same owners.

Hecla Emissions Management introduces FuelEU blockchain trading platform - Launches their “FuelEU Maritime Exchange”, tokenising compliance balances and allows the users to trade on a “per voyage” basis instead of at the end of the compliance period. Notes that they manage the EU ETS compliance of ~35 clients with over 1000 vessels.

Wärtsilä adds EU emissions module to optimisation platform - New module in their Fleet Optimisation Solution designed to support with FuelEU and EU ETS, primarily for tracking and reporting on emissions and regulatory status.

OrbitMI launches FuelEU Maritime tools - And another one tackling FuelEU Maritime as a product expansion from their existing software-offerings.

BV integrates emissions data platform with OrbitMI - While others partner with many for easier emissions reporting, BV integrates with their part-owned affiliate (anyone seen BV integrate with anyone else?). Soon announcing full acquisition perhaps? Their pilot customer is piloting the solution “as agents only, the partners note”.

PortXchange upgrades port emissions monitoring platform - Currently focusing on vessel emissions, but will extend to trucks, rail and cargo handling equipment within the port in the future.

Pole Star Global adds new tools to support emissions compliance - New features? Worth sharing about? Perhaps. Unclear what the new features are, specifically.

On Future Crewing & Safety

Telemedicine leads to reduction in medical disembarkations at CSM - With system from OneCare Group and its member company Marine Medical Solutions, now they can more accurately diagnose the ill crew members and assess if medical evacuation is necessary.

Oceanic Partners with VIKAND to Provide Mental Health Training to Officers - Oceanic’s subsidiary (who again is a subsidiary of V.Ships? Subsidiception?), SeaMed24 Medical Solutions, will offer mental health training in addition to their other digital medical solutions tailored for crew.

NSML deploys telemedicine fleetwide - VIKAND OneHealth is deployed across 13 LNG and LPG carriers, enhancing access to mental and physical health tools for crew onboard. Good month for Vikand.

Danica and IMEQ collaborate on AI monitoring of crew wellbeing - Danica’s shipowners gets access to a psychosocial risk assessment tool, a 15min questionnaire, resulting in actionable insights on factors such as burn-out, workload imbalance, bullying and harassment.

Crew change management system rolled out by Stödig - 1 out of 2 articles on rolling out a Flagship ventures on their fleet here, Stödig. After trialing the solution on 15 vessels they decided to roll out across their entire fleet of 43 owned and managed vessels, when the pilot showed 7% cost savings and 40% improved efficiency benefits.

Baze crew entertainment packages for seafarers from Philippines / India / West - Rolls out three exclusive premium movie and series packages aimed at specific nations and regions on their IPTV solution.

SeaBuddy app for seafarers launched - Sounds like an all-encompassing app, ranging from managing the seafarer’s money and currency conversion to logging working hours and work documentation.

On Port Operations Optimisation

Tideworks Technology upgrades terminal data management tools - Launches a data platform to simplify access to live and historical terminal data, in a dashboard for both rail and marine customers.

On Remote Surveying & Inspection

Body worn camera for crew / field workers to live stream video to remote experts - Getac launches a remote expert solution to support onboard crew. Works on wifi and 4G LTE.

On Connected Vessels

Enabling Digital Vessels

NGM Energy begins IT infrastructure overhaul - Implements new upgrade from Navarino across their 15 vessels, using Starlink as the primary link and with Inmarsat’s Fleet Xpress and other VSAT services as backup where applicable. The new norm?

Intelsat – VSAT communications available cheaper than Starlink - Well, this is true if you’re ok to use whatever bandwidth that happens to be available in your region, if the aviation customers is not using it and when the “higher paying government customers have taken what they need”. Higher speeds, less reliability, costs less than Starlink, only available in high-traffic areas; sounds reasonable?

AST Networks launches hybrid satcom package - An alternative to the above: “The Starlink Companion Bundle”, combining speed from Starlink with reliability from Iridium and cellular data (when accessible I guess), and switching in between the different systems when required.

Marella Cruises adds OneWeb LEO services to vessel fleet - In addition to the already rolled out Starlink systems - in other words: Starlink is too unreliable so customers are demanding redundancy.

Hoppe Marine and Metis in vessel data acquisition partnership - Linking Hoppe’s data collection systems with Metis’ vessel performance management platform for high-frequency data access.

Data shows ‘significant’ rise in malicious maritime cyber activity – report - Marlink reports from their Security Operations Centre, after monitoring 1800 vessels during the first six months of 2024 and compared them to last year. Main target: IoT devices.

Class approves wireless communications gateway for below-deck sensor data - This one went under the radar of most news publications it seems, with Sealution getting type approval from LR their gateway communications device “that enables data from machinery and safety equipment below deck to be transferred wirelessly”. They use radio-waves to transmit data from sensors through steel to the bridge, and is designed to integrate with a standard smoke-detector in merchant vessels.

Digital Vessel Management

SpecTec partners with Procureship and Source2Sea on procurement - Allows AMOS users to reach the ProcureShip’s global marketplace for marine supplies and service providers, as well as integrating the Source2Sea catalogue of products.

Latsco Marine Management in engine data deal with MAN Energy Solutions - Initially to run over 2 years, sharing data on the operation of engines, engine performance and maintenance, focusing on reliability and development of digital products.

Nordic IT and Complexio Announce New Strategic Partnership - Email platform provider integrate with Hafnia and Simbolo’s LLM joint venture, looking to increase productivity and automate processes. Complexio has already automated vessel clearance processes and chartering processes in Nordic IT’s reMARK.

Stödig Ship Management implements Kaiko Systems for SIRE 2.0 - 2 of 2 for Stödig here, rolling out the software on their fleet of 10 tankers - Significant!

Autonomy

CM Technologies introduces engine cylinder wear detection sensor system - Detects early onset cylinder wear on two-stroke engines, using acoustic emissions sensors to analyse the environment within the cylinder.

BIMCO approves first autonomous vessel management contracts - Adopted a new “AUTOSHIPMAN” agreement, for the operation of remotely operated ships at sea. A step on the way done.

On Connected Cargo Operations

Sedna and Seaber announce integration - Integrating Seaber’s Scheduling Intelligence platform with Sedna’s Pulse, which is used to surface cargo information buried in emails.

Organik Kimya deploys FourKites for supply chain data - Chemical manufacturer signs up for visibility to their global shipments, tracking 15,000 global shipments from its factories in Rotterdam and Istanbul.

On Reducing Fuel Consumption

Kawasaki blames engine tampering on organisational dysfunction and lack of customer perspective - So, now we have engine shop test data that has been falsified for decades by Japanese engine manufacturers, means that the vessel performance solutions out there solely relying on models based on shop tests are basically useless? Interesting.

Optimising Navigation & Propulsion

Shipowner Matson testing AI-based thermal cameras to avoid whale strikes - Not quite reducing fuel consumption (perhaps an added benefit?). Testing with the Woods Hole Oceanographic Institution, who has developed a marine mammal detection system.

Optimising Fuel Performance

VPS announces winners of offshore vessel competition to decarbonise the most - The Maress Decarb Summer Campaign closes with 300 vessels participating from 12 companies to reduce emissions (and fuel consumption) through use of the Maress platform, with some winners.

Wärtsilä and Royal Caribbean Group in 37-ship lifecyle agreement - A five-year agreement to manage performance, reliability and availability of the ship engines, including monitoring and planning of maintenance (mentions of predictive maintenance). Contract includes a performance-based commercial model, where gains from the operations and maintenance is shared.

Gazocean in Smart Shipping deal - Signs up their entire fleet (of six vessels) with Ascenz Marorka (of GTT Group) for their vessel performance solutions and LNG cargo monitoring, along with collection of high-frequency data onboard and weather routing services.

MOL develops big data application for fouling analysis - One of the outcomes from a focus area of big data utilisation within MOL, where the system will be used in the maintenance planning of ~500 ships.

Doubling capacity in Singapore in early 2025 - C-Leanship launches a second hull cleaning ROV in Singapore, following a recent approval to operate their propeller polishing ROV in additional terminals in SG.

Assisted Propulsion & Power Generation

BERG Propulsion introduces optimisation software for sails and propellers - Launches “OpWind”, a tool that automatically optimises engine efficiency through propeller RPM and blade pitch angle when wind propulsion is being used.

Anthony Veder becomes first gas shipowner to install wind tech - Installing two VentoFoils from Econowind on an ethylene carrier, anticipates 5% average savings and up to 10% in optimal conditions.

On Future Fuels

US hires ABS to set up clean energy innovation centre for shipping - Focusing on adoption of clean fuels on US ships through R&D and training support, over the next 5 years.

Maersk green guru Morten Bo Christiansen: ‘I’d hate to be seen as endorsing LNG’ - After ordering 30 methanol-fuelled ships last year, suddenly turned to LNG this year - but not an endorsement of fossil LNG. TL;DR - They are hedging their bets.

Ammonia

New autonomous technologies for ammonia-fueled ships gain ABS AiP - Hyundai’s HD HHI and HD KSOE in Korea seals approvals from ABS for 1) an unmanned ammonia engine room and 2) for an “AI safety package” for unmanned ammonia-fueled engine rooms. The engine room is managed on the navigation bridge with a” remote propulsion control station with gas safety technology”. How to convince crew its safe to be on an ammonia ship? You remove the need for them to be near the gas.

US First Approval in Principle for Ammonia Bunkering Vessel - ABS, Fleet Management, Sumitomo Corp and Tote Services announced the first approval in principle for US’ first ammonia bunkering vessel.

First low carbon ammonia powered vessel makes maiden voyage - The tugboat retrofitted with Amogy’s ammonia-to-electrical power technology made its voyage up the Hudson river.

Grieg Group celebrates 140 years as the next generations build on shipping legacy - Discusses their view on ammonia as their main future fuel bet. First short sea, as infrastructure develops locally and subsequently ammonia-ready vessels for deepsea.

Alfa Laval to supply first systems for ammonia-fueled ships by end 2025 - In partnership with WinGD, they delivered two test systems for WinGD’s ammonia-fuelled engines. To be validated by end of 2024 and first marine delivery end of 2025.

Hydrogen

Østensjø PSV will be fitted with LOHC hydrogen fuel cell system - With support from the Norwegian agency Enova, to install Hydrogenious LOHC Maritime’s system, after receiving AiP from DNV.

Electric Powertrain

Nothing noteworthy

Methanol

Wuhan Innovation inks order for 16 new methanol-fuelled bulkers - China’s claimed first coastal vessels to be running on methanol.

ESL Shipping orders “fossil-free” bulker quartet - Wasn’t sure where to put this, as it can be “fossil-free” by using green hydrogen-based e-methanol or biomethanol. Bottom-line: four new handysize bulkers coming up.

Nuclear

Russia revives plan for gas-carrying nuclear submarine for Arctic waters - A 360m long vessel, max 70m wide and capacity of 180k tonnes of LNG. Cuts down time across the north sea route, as there is no need for icebreakers.. This concept however has been revived for years, but not materialised.

Emissions Capture

Erik Hanell: ‘Onboard carbon capture an increasingly viable solution for shipping’ - TL;DR: More R&D will drive down the cost further. Note the nuance of saying “an increasingly viable solution” - not saying it is viable, just increasingly viable. So, we’re getting closer but not there yet - TBD! (And, still a tradeoff of the additional 10-15% fuel penalty due to increased energy requirement to run the capturing system).

Fuel Quality & Procurement

VPS provides fuel quality data to NorthStandard platform - NorthStandard launches Fuel Insights platform, integrating VPS’ fuel quality data, adding onto their “Get SET!” digital portfolio. Is this a two-sided strategy from NorthStandard? Become a promoter of digital (/data) tools so that they themselves can have greater access to data?

Nereus Digital Bunkers updates fuel procurement platform - New fuel procurement marketplace opens up, bringing together physical suppliers, traders and brokers initially, then expanding to surveyors, agents and labs.

MPA Singapore announces deadline date for move to digital bunkering - From 1st of April 2025, the issuance of electronic bunker delivery notes will be the default. In related news, MPA is also launching an LLM application to streamline renewals of Singapore-registered ship certificates.

ICYMI

Singapore’s struggles with cost of living - Rising costs of living and employee costs in Singapore leads Ship Managers to start considering moving staff to different cities, while staff on entry- to mid-level salaries struggle to get by and have started considering other countries where they can live more comfortably. Splash247 market report on Singapore.

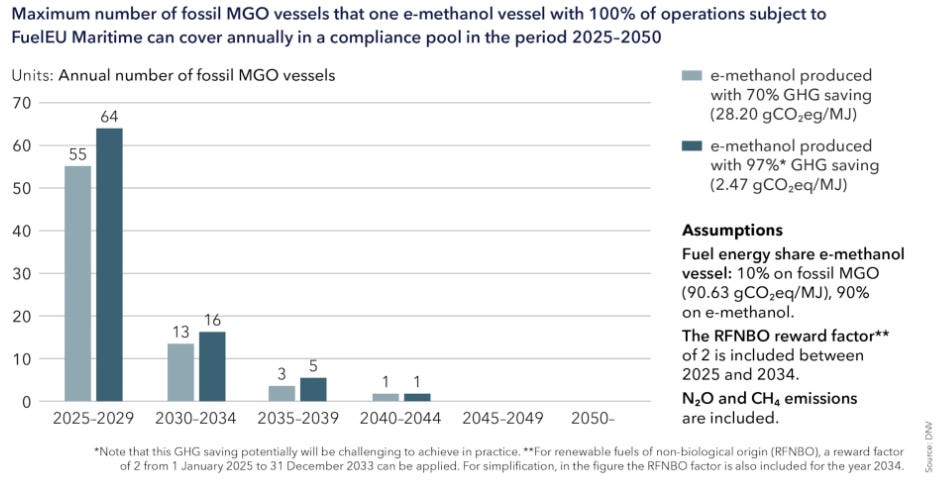

Modelling the policy impacts on emissions strategies, fuels and future costs - DNV with an educational piece on FuelEU Maritime, showing (amongst other things) that one e-methanol vessel can give a big compliance surplus, especially in the first five years. Recommended read.

Tidbits and food for thought around start-ups and ventures

Vertical SaaS: Now with AI Inside - From a16z, discussing the evolution of how different technologies scales Vertical SaaS, now with AI. First wave of scaling was with cloud, then cloud+fintech (adding payment options) and now with AI addng further scale through automating sales, marketing, customer service, etc.

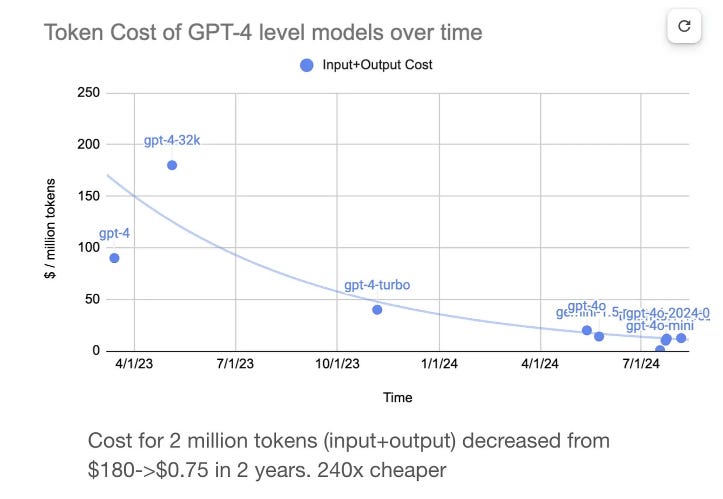

The plummeting cost of intelligence - This graph says it all:

HOW TO SUCCEED IN MRBEAST PRODUCTION - For the youtubers of the readers, gives some interesting insights of how the top youtube channel thinks - and how a high-performing organisation can work.

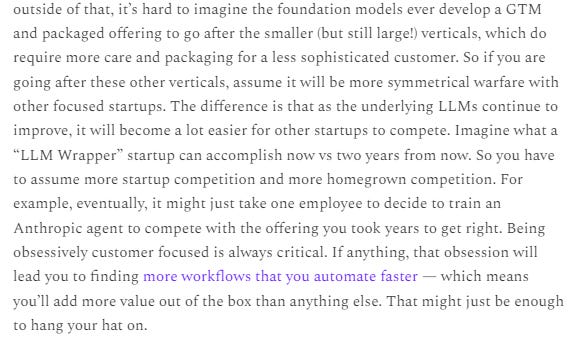

Thinking through the future for LLM companies... and what this means for B2B AI startups - Think this section summarises quite neatly the conundrum of LLM startups:

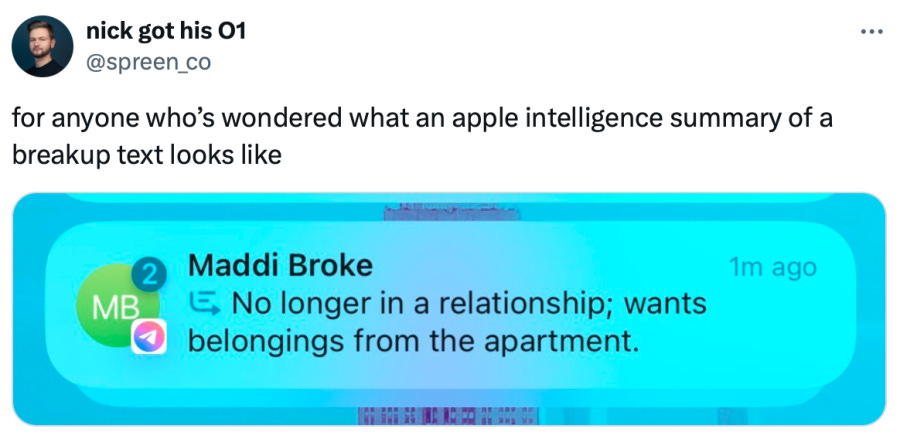

Apple Intelligence features can also summarize breakup texts for you - And less fun part of AI evolution:

Generative AI’s Act o1 - Ending with an exciting article from Sequoia and their view of the GenAI revolution, particularly around inference (reasoning) models. The article and their view of where to compete can be summed up with this quote:

Imagine you want to start a business in AI. What layer of the stack do you target? Do you want to compete on infra? Good luck beating NVIDIA and the hyperscalers. Do you want to compete on the model? Good luck beating OpenAI and Mark Zuckerberg. Do you want to compete on apps? Good luck beating corporate IT and global systems integrators. Oh. Wait. That actually sounds pretty doable!

Happy week!